Key Takeaways

- Debt Recycling: Transform "inefficient" home loan debt into tax-deductible "efficient" debt to accelerate mortgage repayment and wealth creation.

- Diversified Investing: Use a mix of Australian shares (for franking credits), international ETFs, and fixed interest to manage 2026 market volatility.

- Wealth Protection: Prioritise life, TPD, and income protection to safeguard your family's future against unexpected illness or injury.

- Compound Growth for Kids: Start small with regular savings plans or minor trust accounts to give your children a significant financial head start.

- Superannuation Strategy: Utilise salary sacrifice to reduce taxable income while building a robust retirement nest egg early.

When you start a family, your focus naturally shifts toward family financial planning - a dual strategy of wealth creation and wealth protection. The major milestones of life, such as a young family, a first home, a career shift, or an inheritance, provide the perfect opportunity to conduct a comprehensive review. In 2026, with moderate economic growth and "sticky" inflation, a proactive approach is essential to ensure your household remains resilient.

Strategic Debt Management for Families

In your thirties and forties, debt is often a primary tool for achieving lifestyle goals. However, not all debt is created equal. Understanding the difference between efficient and inefficient debt is the cornerstone of wealth management.

Efficient vs. Inefficient Debt

- Efficient Debt: This is debt used to purchase income-generating assets, such as shares or investment property. The interest costs are generally tax-deductible, and when these assets grow in value, the debt facilitates significant wealth creation.

- Inefficient Debt: Loans for non-income producing assets (like a car or a holiday) offer no tax deduction. These are a drain on your long-term wealth accumulation and should be prioritised for repayment.

Ways to Reduce Inefficient Debt

To accelerate your journey to financial freedom, consider these practical steps:

- Understand Your Cashflow: Use automated tools to track spending and ensure you are making the maximum possible loan repayments.

- Utilise Offset Accounts: Keeping your savings in a 100% offset account reduces the interest charged on your home loan while maintaining full access to your cash.

- Debt Recycling: Work with a Morgans adviser to implement a debt recycling strategy. This involves paying down your non-deductible home loan and redrawing those funds into a separate investment loan to buy income-producing assets.

Investment Strategies for 2026

With a long-term horizon, families in their thirties and forties can use time to their advantage. A balanced approach across different asset classes is the best defence against market uncertainty.

Shares and ETFs

Whether you are using your own cash or borrowing to invest, investing in shares remains a primary wealth-building tool.

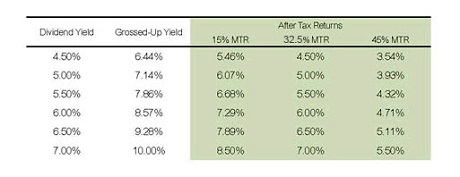

- Australian Shares: Highly valued for their franking credits, which can provide a significant "grossed-up" return after tax benefits are included.

- International ETFs: Essential for diversification, allowing your family to participate in global growth sectors like technology and AI.

Property and Fixed Interest

You can choose to invest directly in physical property or via listed property trusts (REITs). Complementing these growth assets with fixed interest products like corporate bonds or term deposits provides capital certainty and a reliable income stream.

Wealth Protection: Securing the Family Unit

Greater financial responsibility, mortgages, marriage, and children, means the impact of illness, injury, or death is significantly magnified. Protecting your family through comprehensive insurance is an urgent priority.

Your Protection Options

- Life and TPD (Total and Permanent Disablement): Provides a lump sum to clear the mortgage and secure your children's future.

- Trauma Insurance: Offers a lump sum upon diagnosis of a serious illness (like cancer or heart attack) to cover medical costs and recovery.

- Income Protection: Ensures you can continue to meet daily living expenses and school fees if you are unable to work.

- Business Expense Insurance: Vital for the self-employed to ensure the business survives while they recover.

Superannuation: The Long-Term Engine

This is the time to get serious about your super. Small changes made now will reap massive rewards when you eventually transition to retirement.

Salary Sacrifice

Foregoing a portion of your pre-tax salary to increase super contributions is a powerful double-win. It reduces your current taxable income while boosting your savings in a low-tax environment.

Regular Savings and Dollar-Cost Averaging

Implementing a regular savings plan for goals like your children's education or a home renovation allows you to benefit from "dollar-cost averaging." This systematic approach means you buy more units when prices are low, lowering your average cost over time.

Navigating the complexities of debt, investments, and protection is a full-time job. By focusing on asset allocation and seeking professional advice, you can ensure your family's long-term strategy remains on track.

Contact a Morgans adviser today to start your family's financial roadmap or find a local branch to discuss your wealth goals.

Frequently Asked Questions

What is the 50/30/20 rule for family budgeting?

The 50/30/20 rule suggests allocating 50% of your income to needs (rent, groceries), 30% to wants (hobbies, dining out), and 20% to savings or debt reduction. It is a simple framework to ensure you are consistently building wealth.

How does debt recycling work in Australia?

Debt recycling involves using surplus cash to pay down your non-deductible home loan, then redrawing that same amount as a separate investment loan. Because the new loan is used to buy income-producing assets, the interest becomes tax-deductible.

Why are franking credits important for my family portfolio?

Franking credits prevent "double taxation." Since the company has already paid tax on its profits, the credit passed to you can reduce your personal tax bill or even result in a tax refund, effectively boosting your investment return.

How much emergency savings should a family have?

Financial experts generally recommend having three to six months of essential living expenses tucked away in a high-interest savings account or an offset account to cover unexpected job loss or medical emergencies.

Can I set up an investment account for my children?

Yes. Popular options include Vanguard Kids accounts or Minor Trust accounts. These allow you to invest in shares or ETFs on behalf of a child, which can then be transferred into their name once they turn 18.

Is income protection worth it if I have it in my super?

While many people have "default" cover in super, it is often limited. Personal income protection usually offers better features, such as "own occupation" definitions and higher benefit amounts, which can be critical for high-earning professionals.