Research notes

Stay informed with the most recent market and company research insights.

Research Notes

1H24 result: Are we there yet?

1H24: UHF reaches first close

1H24 earnings: Tolerate It

1H broadly in line; Behring GPM up, Seqirus/Vifor soft

Increasing ROE and Accenture partnership impress

Getting in to water-out

In a hot spot

The need to get leaner (again)

Offshore to be a key driver, not just a passenger

Step change in DPS and/or buyback fast approaching

News & insights

Why The US Has Higher Productivity

Good morning. Today I want to talk about the U.S. economy in comparison, to other economies and, why it's performing, the way it is. The documents I will refer to are first the IMF, outlook, which is, come out in the last two weeks. That gives us some international comparisons.

For the US economy I use, the monthly outlook from Standard and Poor's, which is, the number one rated by the Congressional Budget Office, well ahead of other economic forecasters. For the US economy, both the IMF and, Standard Poor's agree that growth this year should be 2%. Our own model of the US economy, based on the Chicago Fed National Activity Indicator, is also forcasting US growth of 2%.

Still, that's 2% is less whatever the negative effect is from, from the US shutdown. When the shutdown continues for a month, that growth rate falls from 2% down to about 1.8 % 1.7%. So it's a moderate slowdown. Still growth in the U.S. economy accelerates next year to about 2.2%. I'll talk later on where that growth is coming from.

When we look at growth in other areas we see that: Euro area is miserable. Great Britain is growing faster than the Euro area now. This year the UK should grow by 1.3% but, the Euro area should grow by about 1.2% this year. Euro area growth drifts off to an even more miserable 1.1% next year. But fortunately, that generates a lot of savings to invest in other countries like us. Those savings then go in to the US equities and bond markets and, the Australian stock market and places like that.

China is slowing down to 4.8% this year and 4.2% next year according to the, IMF. Still, heroically India, marches on to 6.6% growth this year and 6.2% next year. For emerging markets, which include the Indo Pacific generally ,Growth is proceeding at about 5.2% this year and 4.7%, next year.

The U.S is still, pretty good in comparison. This year, it's, growing at 2% or, depending on the results of the shutdown. Next US Growth accelerates, to 2.2%, and growth is then about the same the year after.

There's been a lot of debate this year about the effect of tariffs on the US inflation. In spite of higher tariffs , US inflation is stubbornly , stubbornly low. Headline inflation, which includes food and energy this year should be only 2.8%. Hardly something to scare markets. And that continues a 2.9% next year and 2.5% the year after. Amazingly,US core inflation is a bit higher than that 3% this year and 3.3% next year. It's just that food and energy prices are falling in the US. Why can't that happen here?

Lets look at one of the reasons that you get really quite steady growth and relatively low inflation in the US The comparison I want to make here is between US output per hour and Australian output per hour. In the beginning of this year, we had a shocking slowdown in productivity growth because our government decided that was better to hire more, people from the public service than generate employment in the private sector. It is well known that, productivity in the market economy grows much faster than in the, than in the public sector. So, for the first quarter, productivity in Australia grew, or output per hour worked per annum ,grew by 0.3% . The RBA has told us that, they expect output per hour that will rise to about 0.7%per annum , the same as the UK. And we'll be able to maintain productivity growth rate of 0.7%, going forward.

Let's compare that to what's happening in the US economy. This year It looks like the US will be producing labour productivity much higher than the Australia. US Output per hour should grow by 1.6% this year . Next year US Output per hour may grow even more by, 2.1%. Following that US labour productivity the year should grow between 1.6 and 1.7%,. This is full 1% faster than, the Australian economy is expected to grow in terms of productivity. Remember, it's growth and productivity which generates increase in living standards.

There's two reasons, that we can provide for why the U.S., productivity is growing so much faster than ours. One is a flexible labour market. It's an extremely flexible labour market in the US. The current Australian government has made our labour market less flexible, less than it previously was. A second reason is deregulation . The program of deregulation by the US administration is making it easier for business , to do business.

That, of course, in turn generates higher levels of business investment. That higher level of business investments creates more growth. So, it's a series of policies which are different in each country . The result will be that, living standards in, in the U.S are going to start going to be growing significantly faster than they are in Australia.

And that's the end of the good news for the day.

Last time I spoke to you about Australian inflation and its effect on what the RBA might do in its November meeting, I said that expectations for inflation for the year to September, which would be published in October, were between 2.5% and 2.7%. I also said that if inflation came in at the lower estimate of 2.5%, then we could see a rate cut in November.

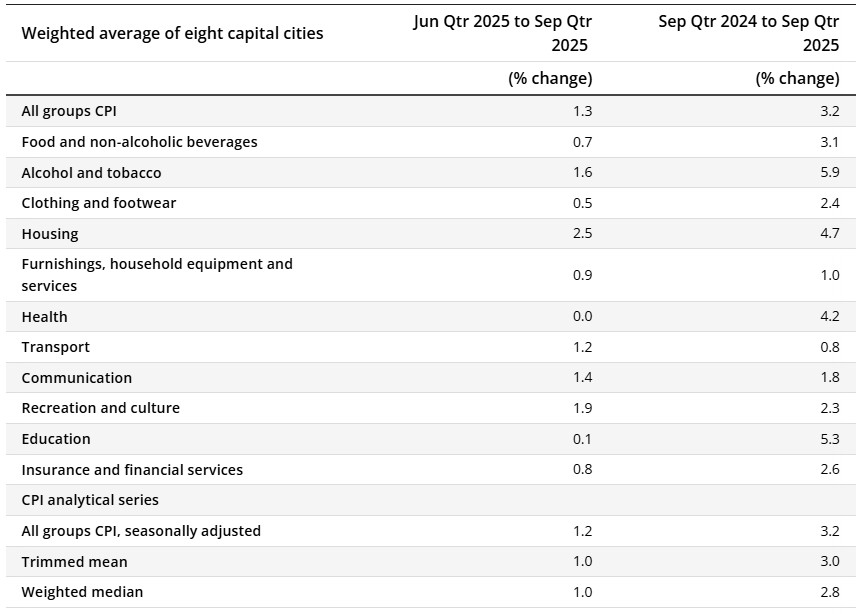

Well, the numbers are out, and unfortunately, not only are we not getting a rate cut in November, it’s unlikely we’ll see another rate cut any time soon. In fact, it’s fair to say we may be at the very end of the rate-cutting cycle in Australia. The reason is that the core measure, the trimmed mean, which is the RBA’s preferred measure of underlying inflation, came in not at 2.5%, not at 2.6%, and not even at 2.7%, but at a shockingly high 3%.

This result was driven by a 1.3% increase in prices in the previous quarter, which annualises to about 5%, a surprise that wasn’t anticipated. Looking deeper into the quarterly CPI, we saw housing prices rising at 4.7%, health costs up 4.2%, and education costs increasing by 5.3%.

The ABS has indicated that the major source of inflation was a jump in goods inflation, which rose 3%, up 1.1% from the previous quarter, or 4.4% annualised. The standout contributor was electricity, which saw a massive year-on-year increase of 23.6%. Other household fuels actually fell by 1.6%, and annual services inflation was 3.5%.

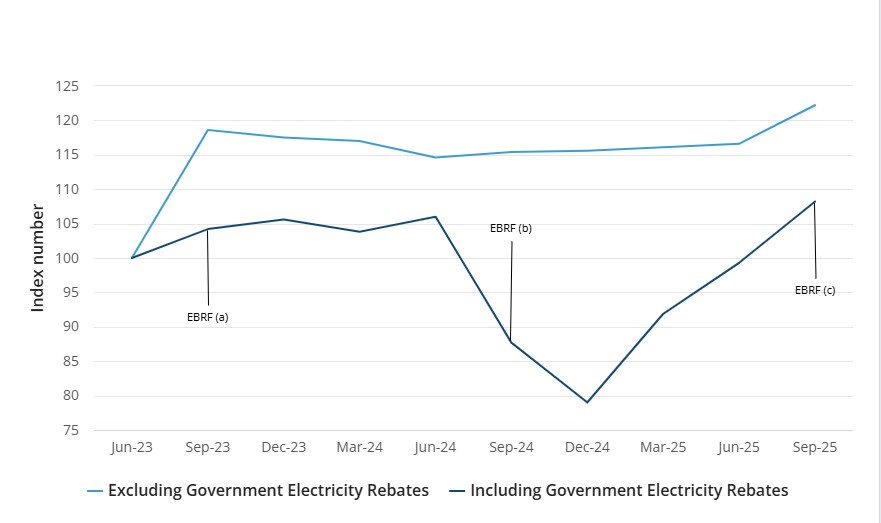

The ABS attributed this unexpected rise in inflation primarily to electricity prices. But it’s not just electricity prices themselves, it’s the end of Federal Government funding to the states that had been keeping those prices low.

The ABS reported that electricity prices rose 23.6% over the past 12 months, largely because State Government rebates, funded by the Commonwealth under the Energy Bill Relief Fund, have now been used up. These rebates included Queensland’s $1,000 rebate, Western Australia’s $400 rebate, and Tasmania’s $250 rebate. With these rebates exhausted, electricity prices have surged.

The A

BS data shows electricity prices excluding government rebates, and highlights the impact of the federal funding. Electricity prices really took off in 2023, rising by almost 20%, which posed a political risk for the Federal Government. In response, the Government provided funding to State Governments to suppress those prices. There were schemes in both 2023 and 2024, and ahead of the last election, the subsidised price paid by consumers dropped to around 80% of the original cost, well below the actual cost of generation.

However, since December 2024, those subsidies have been reduced. Over the past year, prices have climbed again, though they remain below the unsubsidised cost, which is now around 122% of the original price, or about a quarter higher than where things stood in 2023.

The result of all this is 3% core inflation. If inflation had come in at 2.5%, rates could have fallen from 3.6% to 3.35%. But with 3% core inflation, rates should need to rise by 25 basis points. That said, we’re likely at the end of the rate-cut cycle.

Is the RBA likely to raise rates? They might consider it, but this is cost-push inflation, not demand-driven inflation, so increasing rates wouldn’t help. It would only worsen the situation. This very high inflation figure, driven by the end of federal electricity subsidies, signals the end of the current series of Australian rate cuts.

Key Takeaways

- Press pause. Park funds safely while you confirm what you received, obligations, and any tax implications.

- Build a plan that fits your goals and timeframes. Prioritise cash buffers, debt decisions, investing, super, and estate wishes.

- Get advice early. A financial adviser and tax accountant can help you avoid costly mistakes and set up a long-term strategy.

- Use professional inheritance financial advice to align tax, super, investing, and estate planning decisions.

Receiving a large inheritance can be life-changing. It can also feel overwhelming. The right first steps help you protect capital, make clear decisions, and turn a windfall into lasting financial security. This guide walks you through a practical process Morgans advisers use with clients every day, with a focus on inheritance financial advice tailored to Australian rules.

Step 1: Pause and assess your situation

Before making big choices, slow down.

- List the assets you have inherited: cash, property, superannuation, shares, term deposits, insurance proceeds, or a business interest.

- Confirm control and timing. Has probate been granted? Are there executor timelines or sale constraints?

- Check any liabilities. Some assets may come with debts, fees, rates, or ongoing costs.

- Gather documents. Will, probate, estate distribution statement, title records, super death-benefit statements, cost-base records for property and shares.

Short term, consider holding funds in high-interest savings or term deposits while you complete the groundwork. ASIC’s Moneysmart has clear tips on handling large amounts of money.

Step 2: Understand the emotional impact

An inheritance often follows the loss of a loved one. It is normal to feel pressure to act quickly. Give yourself time.

- Avoid large purchases until you have a plan.

- Set simple rules. For example, no irreversible decisions for 30 to 90 days.

- Write down your goals and values. What will this money do for you, your family, or future generations?

- If you feel rushed by offers or schemes, step back and check for red flags. Scamwatch has practical guidance.

Step 3: Map your goals and timeframes

Your strategy should mirror when you will need the money.

- 0 to 2 years (short term): capital protection and liquidity. Cash, term deposits, or an offset account.

- 3 to 7 years (medium term): a diversified mix of income and growth.

- 7 years plus (long term): growth-focused assets with disciplined risk management.

Align each dollar with a job: emergency fund, debt choices, home or investment property plans, children’s education, retirement savings, or charitable giving.

Step 4: Tax and rules to consider

Australia has no inheritance or estate tax. You can still face tax on income or gains from inherited assets. Seek written advice before selling or restructuring.

- Property. Capital Gains Tax (CGT) can apply when you sell. A main-residence exemption may be available in some cases and there is a two-year timing rule, with possible extensions in limited circumstances. The ATO has more information on extensions to the 2-year ownership period.

- Shares and managed funds. You usually inherit the deceased’s cost base. Future gains or income may be taxable in your hands.

- Superannuation death benefits. Tax depends on your relationship to the deceased and the components of the benefit. ATO guidance explains who counts as a dependant and how tax is applied.

- Pension and benefits. A large inheritance can affect Centrelink assessments under the income and assets tests. Check how your position may change.

Step 5: Build a financial strategy

This is where professional inheritance financial advice makes a clear difference. A tailored strategy can help you:

- Preserve capital while generating reliable income.

- Create an optimised tax position.

- Invest based on your risk profile and timeframes.

- Plan for retirement or intergenerational goals.

Common strategies include:

- Diversified portfolios. Combine cash, fixed income, Australian and global shares, property, and alternatives.

- Superannuation contributions. Use concessional and non-concessional contributions where appropriate, subject to caps and personal circumstances.

- Debt reduction or offset use. Compare the after-tax, after-fee return from investing with the guaranteed saving from reducing non-deductible debt.

- Property investment. Weigh cash flow, rates, maintenance, tenancy risk, and diversification.

- Philanthropy. Structured giving can align with your values and tax planning.

Step 6: Make considered debt decisions

A lump sum tempts quick mortgage paydowns or new borrowing. Test options with advice.

- Offset first. Parking cash in an offset account can cut interest while keeping flexibility.

- Compare outcomes. Paying down non-deductible debt is often strong, but do not drain all liquidity.

- Avoid new lifestyle debt. Large purchases can wait until your plan is set.

Step 7: Invest with discipline

Good portfolios are simple, diversified, and low friction.

- Use broad market building blocks supported by high-quality research.

- Keep fees and taxes in focus.

- Rebalance periodically to maintain your risk level.

- Document an investment policy statement you can stick to when markets move.

Step 8: Update your own estate plan

An inheritance is a prompt to review your legal documents.

- Update your will and enduring powers if your situation has changed.

- Review super nominations and life insurance beneficiaries.

- Consider a testamentary trust if suitable for family protection or flexibility.

Learn more about Estate Planning with a Morgans adviser.

Step 9: Avoid common mistakes

Many Australians make avoidable errors with inherited wealth, such as:

- Making large purchases without a plan

- Ignoring tax consequences when selling assets

- Failing to diversify or taking concentrated bets

- Chasing high returns promised by unlicensed operators

- Not seeking professional advice early enough

Use checklists, document your decisions, and keep a record of key statements and dates.

Step 10: Work with a Morgans financial adviser

Every inheritance is unique, and so is your financial journey. A Morgans adviser can help you:

- Clarify goals, timelines, and trade-offs

- Model debt vs invest decisions

- Design a diversified portfolio to suit your risk profile

- Coordinate with your accountant and solicitor on tax and estate matters

- Set up a review rhythm so your plan stays on track

Contact us today for a free consultation with a Morgans adviser. Let us help you turn your inheritance into long-term financial security.

Learn more with our superannuation advice, financial planning, retirement and estate planning.

Frequently asked questions

1) Do I pay tax on inherited money in Australia?

There is no inheritance or estate tax. You may still pay tax on income or gains from inherited assets. CGT can apply if you sell property or shares you inherited. Tax may apply to some superannuation death-benefit payments depending on your relationship to the deceased and the components of the benefit.

2) Should I pay off my home loan or invest the inheritance?

It depends on interest rates, risk tolerance, cash flow, and timeframes. Many clients park funds in an offset account first, then decide with advice. Compare the saving from reducing non-deductible debt with the expected after-tax return from investing. A written plan helps you commit to the path you choose.

3) What if I inherit a house?

Decide whether to live in it, rent it, or sell. Each option has different tax, cost, and lifestyle impacts. Keep records of valuations, costs, and dates. Speak to your adviser and tax specialist before you sign a contract. ATO guidance covers CGT rules and timing, including the two-year rule and limited extension grounds.

4) Who should I talk to first?

Start with a licensed financial adviser and a tax accountant. If property or complex structures are involved, engage a solicitor. Your financial adviser can coordinate the team and build a step-by-step plan.