Research notes

Stay informed with the most recent market and company research insights.

Research Notes

Multiple levers to pull for growth

Delivering to plan

Momentum building in Defence

Short-term volatility, long-term fertility

Locked and loaded

Defensively positioned

FY25 result

Data centre deployment underway

Model update

Time to go harder - spending $1 to make $6

News & insights

There is more to what happened at Jackson Hole than just the speech by Jay Powell.

In my talk last week ,I said that our model of the Fed funds rate stood at 3.65%. This is actually 70 basis points lower than the actual level of 4.35%.

I also said that the Fed was successfully achieving a "soft landing" with employment growing at 1%. This was below the median level of employment growth since 2004 of 1.6%.

Still , as I listened to Jay Powell Speak , I noted a sense of concern in his voice when he said that "The July employment report released earlier this month slowed to an average pace of only 35,000 average per month over the past three months, down from 168,000 per month during 2024. This slowdown is much larger than assessed just a month ago."

My interpretation of this is that Chair Powell may be concerned that the "soft landing " achieved by the Fed may be in danger of turning into a "hard landing". This suggested a rate cut of 25 basis points by the Fed at the next meeting on 17-18 September.

This would leave the Fed Funds rate at 4.1%. This would mean that the Fed Funds rate would still be 45 basis points higher than our model estimate of 3.65%. Hence the Fed Funds rate would remain "modestly restrictive."

Dire Demography?

Jackson Hole was actually a Fed Strategy meeting with many speakers in addition to Jay Powell.

Two speakers who followed on the afternoon of his speech were Claudia Goldin, Professor at Harvard

and Chad Janis of Stanford Graduate Business School. They each gave foreboding presentations on the demography of developed economies.

Claudia Goldin spoke on "The Downside of Fertility". She noted that birth rates in the Developed World are now generally below replacement level. The Total Fertility rate is below 2 in France , the US and the UK.

It is dangerously low below 1.5 in Italy and Spain and below 1 in Korea. She observes that the age of first marriage of couples in the US is now 7 years later than it was in the 1960's. This reduces their child bearing years.

This paper was then followed by a discussion of it by Chad Janis of Stanford Graduate Business School. He noted that there is a profound difference between a future with a replacement rate of 2.2 kids per family , which he called the "Expanding Cosmos" with

• Growing population leading to a growing number of researchers, leading to rising living standards and Exponential growth in both living standards and population AND a replacement level of 1.9 kids per family which leads to

• Negative population growth , which he called "an Empty Planet " and the end of humanity

as numbers of researchers declines and economic growth ceases.

Of course this seems all very serious indeed . Perhaps what this really means ,is that if we want to save the world , we should just relax and start having a lot more fun!!

Today, we’re diving into how the Reserve Bank of Australia (RBA) sets interest rates as it nears its target of 2.5% inflation, and what happens when that target is reached. Back in 1898, Swedish economist Knut Wicksell published *Money, Interest and Commodity Prices*, introducing the concept of the natural rate of interest. This is the real interest rate that maintains price stability. Unlike Wicksell’s time, modern central banks, including the RBA, focus on stabilising the rate of inflation rather than the price level itself.

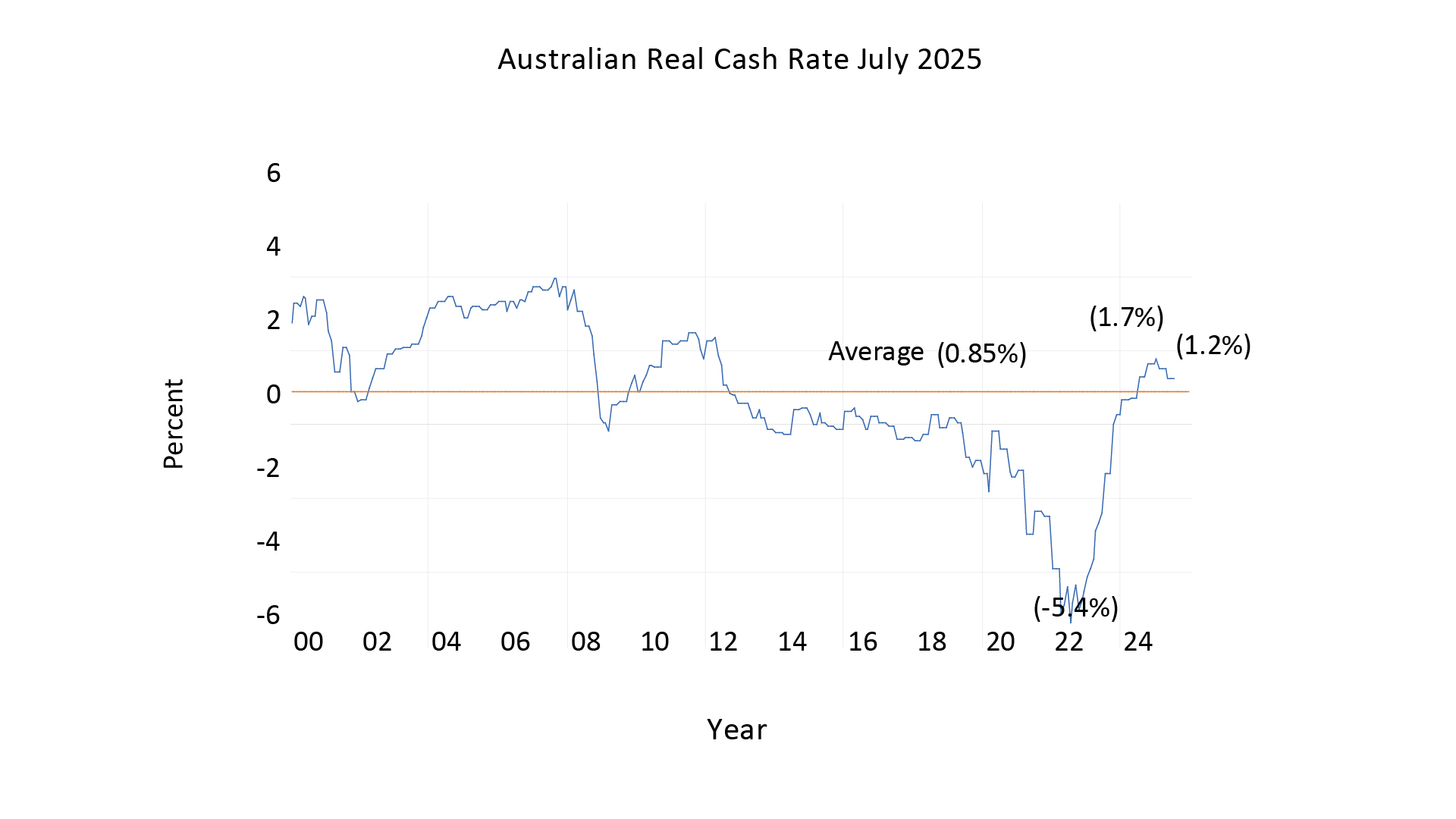

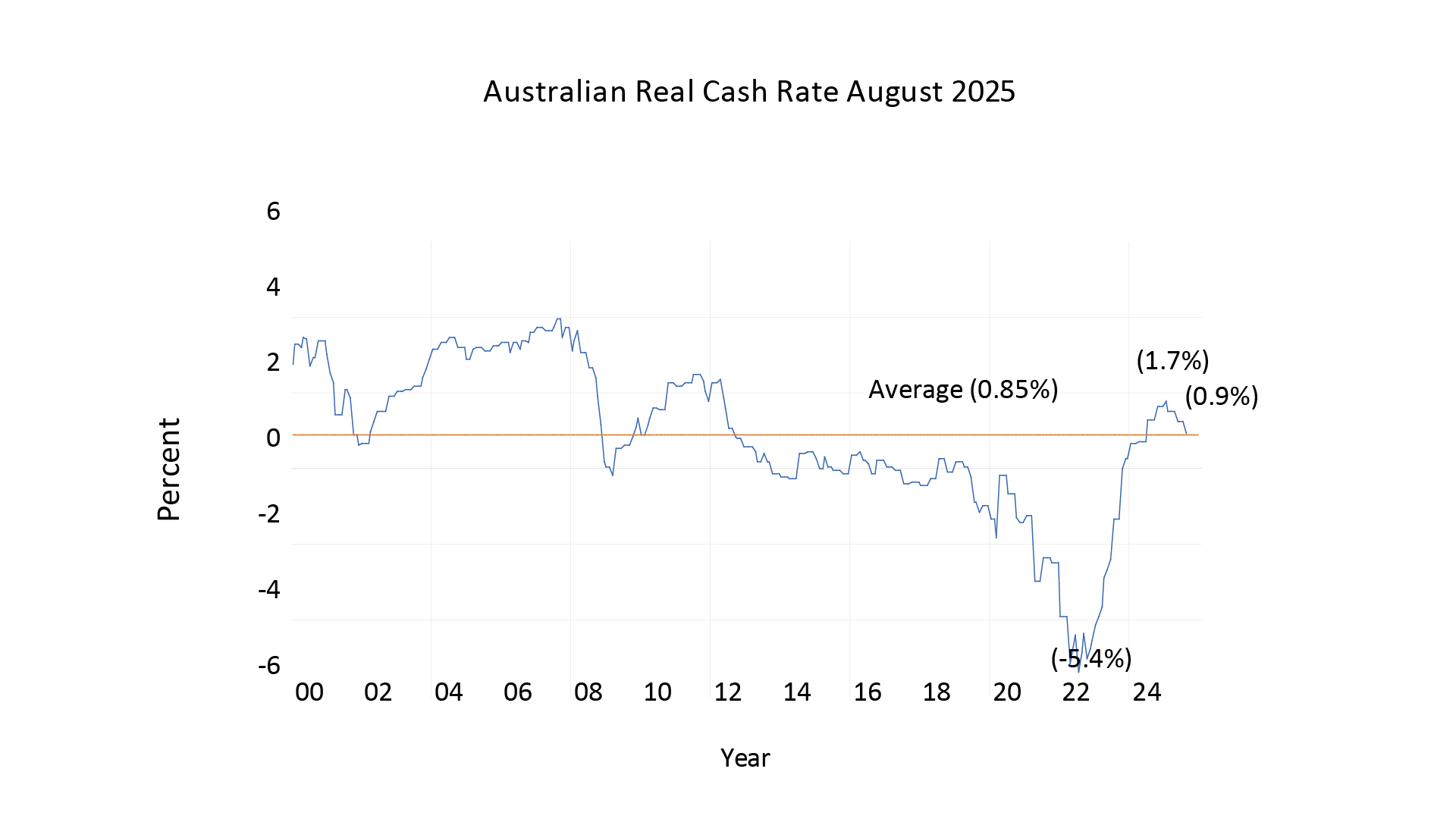

In Australia, the RBA aims to keep inflation at 2.5%. To achieve this, it sets a real interest rate, known as the neutral rate, which can only be determined in practice by observing what rate stabilises inflation at 2.5%. Looking at data from January 2000, we see significant fluctuations in Australia’s real cash rate, but over the long term, the average real rate has been 0.85%. This suggests that the RBA can maintain its 2.5% inflation target with an average real cash rate of 0.85%. This is a valuable insight as the RBA approaches this target.

As inflation nears 2.5%, we can estimate that the cash rate will settle at 2.5% (the inflation target) plus the long-term real rate of 0.85%, resulting in a cash rate of 3.35%. At the RBA meeting on Tuesday, 12 August, when the trimmed mean inflation rate for June had already dropped to 2.7%, the RBA reduced the real cash rate to 0.9%, resulting in a cash rate of 3.6%.

We anticipate that when the trimmed mean inflation for September falls to 2.5%, as expected, the cash rate will adjust to 2.5% plus the long-term real rate of 0.85%, bringing it to 3.35%. The September quarter trimmed mean will be published at the end of October, just before the RBA’s November meeting. We expect the RBA to hold the cash rate steady at its September meeting, but when it meets in November, with the trimmed mean likely at 2.5%, the cash rate is projected to fall to 3.35%.

In recent weeks, a number of media commentators have criticized Donald Trump's " One big Beautiful Bill " on the basis of a statement by the Congressional Budget Office that under existing legislation the bill adds $US 3.4 trillion to the US Budget deficit. They tend not to mention that this is because the existing law assumes that all the tax cuts made in 2017 by the first Trump Administration expire at the end of this year.

Let’s us look at what might have happened in January 2026 if the cuts in US corporate tax rates in Trumps first term were not renewed and extended in the One Big Beautiful Bill.

Back in 2016 before the first Trump administration came to office in his first term, the US corporate tax rate was then 35%. In 2017 the Tax Cut and Jobs Act reduced the corporate tax rate to 21%. Because this bill was passed as a "Reconciliation Bill “, This meant it required only a simple majority of Senate votes to pass. This tax rate of 21% was due to expire in January 2026.

The One Big Beautiful Bill has made the expiring tax cuts permanent; this bill was signed into law on 4 July 2025. Now of course the same legislation also made a large number of individual tax cuts in the original 2017 bill permanent.

What would have happened if the bill had not passed. Let us construct what economists call a "Counterfactual"

Let’s just restrict ourselves to the case of what have happened in 2026 if the US corporate tax had risen to the prior rate of 35%.

This is an increase in the corporate tax rate of 14%. This increase would generate a sudden fall in US corporate after-tax earnings in January 2026 of 14%. What effect would that have on the level of the S&P 500?

The Price /Earnings Ratio of the S&P500 in July 2025 was 26.1.

Still the ten-year average Price/ Earnings Ratio for the S&P500 is only 18.99. Let’s say 19 times.

Should earnings per share have suddenly fallen by 14%, then the S&P 500 might have fallen by 14% multiplied by the short-term Price/ Earnings ratio.

This means a likely fall in the S&P500 of 37%.

As the market recovered to long term Price Earnings ratio of 19 this fall might then have ben be reduced to 27%.

Put simply, had the One Big, beautiful Bill not been passed, then in 2026 the US stock market might suddenly have fallen by 37% before then recovering to a fall of 27% .

The devastating effect on the US and indeed World economy might plausibly have caused a major recession.

On 9 June Kevin Hassert the Director of the National Economic Council said in a CBS interview with Margaret Brennan that if the bill did not pass US GDP would fall by 4% and 6-7 million Americans would lose their jobs.

The Passage of the One Big Beautiful Bill on 4 July thus avoided One Big Ugly Disaster.