Why Australia Is Heading for More Rate Hikes Than Most Expect

This article is a re‑worked interpretation of Michael Knox’s direct words. You can view the full presentation in the video above.

Key takeaways

- Australia is likely to experience four RBA rate hikes, not two, due to persistent inflation.

- Retail electricity prices are set to rise sharply as government subsidies end.

- High immigration combined with federal deficit spending is adding to inflationary pressure.

- The RBA’s own rate‑setting model implies a cash rate closer to 4.6 percent.

- Inflation is expected to climb again in the second half of 2026 which will prompt further tightening.

Introduction

The Reserve Bank of Australia (RBA) has lifted the cash rate by 25 basis points at its latest meeting, signalling the start of a more prolonged tightening cycle. While many economists believe the RBA will need only two more rate hikes, Michael Knox argues that this view does not account for structural inflation pressures already building within the Australian economy.

His modelling and economic analysis suggest the real requirement is at least four rate hikes before inflation begins to ease.

Why the Consensus on Rate Hikes Is Underestimating the Problem

A broad consensus suggests only two additional rate increases will be necessary. Knox’s short‑rate model tells a very different story. The model, which he has used since 1990, explains nearly 90 percent of historical interest rate movements.

The model’s true equilibrium cash rate: 4.6 percent

- RBA typically sets the cash rate about 85 basis points above core inflation.

- Core trimmed mean inflation is currently 3.3 percent.

- This implies a cash rate target of roughly 4.15 percent.

- Knox’s equilibrium estimate sits between 4.72 and 4.76 percent.

The current rate remains well below these levels, meaning the RBA still has more work to do.

Electricity Prices Are the Hidden Inflation Driver

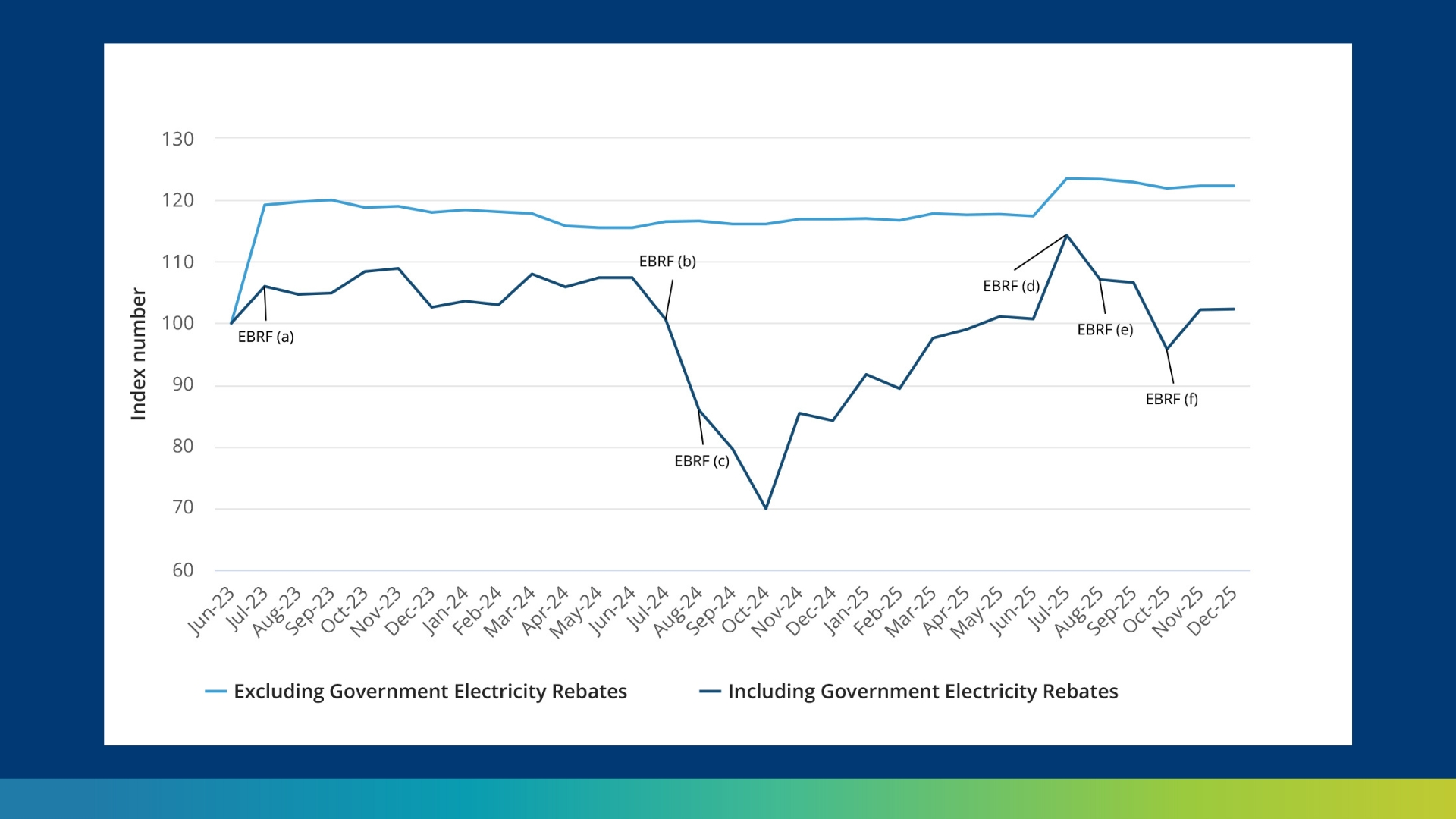

One of the most influential contributors to future inflation is the approaching jump in retail electricity prices.

The subsidy that kept prices artificially low

At the end of 2025, the government removed a nine‑billion‑dollar annual subsidy that:

- Held retail electricity prices 23.5 percent below the cost of generation.

- Prevented the gap between costs and consumer pricing from impacting CPI.

Even though prices have only started rising slightly, there is still a significant gap to close. This gap will narrow quickly as retail prices catch up to generation costs throughout 2026.

Electricity price increases take months to flow into CPI

Based on historical patterns:

- Increases in electricity costs flow into CPI within four to six months.

- This means businesses adjust prices later once higher energy costs take effect.

- The real inflation impact will be most visible in the second half of the year.

Result: inflation rises again

Knox expects inflation to climb to around 4 percent later in the year as electricity costs spread through the broader economy.

Population Growth and Fiscal Policy Are Adding More Fuel to Inflation

Australia’s strong immigration levels normally provide enough demand to support economic growth without government deficits. Skilled migrants generate significant additional economic activity because they typically qualify for mortgages, which amplifies their contribution to demand.

However, the current economic environment includes:

- High immigration.

- A federal underlying cash deficit of 36.5 billion dollars.

This combination increases demand but does not create proportional output. The result is additional inflationary pressure rather than real growth.

What This Means for Interest Rates in 2026

Putting all factors together, Knox’s analysis points to:

- Four RBA rate hikes in 2026.

- A target cash rate of at least 4.6 percent.

- A longer tightening cycle than markets expect.

Australia is now at the beginning of a more substantial shift in interest rates, driven by structural pressures that will intensify throughout 2026.

FAQs

1. Why are four rate hikes more likely than two?

Knox’s modelling shows the RBA is still far below the neutral cash rate, and rising electricity prices will push inflation higher.

2. How do electricity prices affect inflation?

Higher energy costs lift operating expenses for households and businesses. These costs then flow through to the prices of goods and services.

3. When will the inflation impact be most noticeable?

Electricity‑driven inflation typically appears four to six months after price changes, meaning the second half of the year will feel the strongest effects.

4. How does immigration contribute to inflation?

High‑skilled migrants add large amounts of housing‑related demand, which boosts economic activity and contributes to price pressures.

5. What peak cash rate does Knox expect?

A rate of at least 4.6 percent, consistent with long‑term equilibrium modelling.

6. Could inflation ease faster than forecast?

This would require electricity prices to stabilise or fall, which is unlikely based on current generation cost pressures.

Conclusion

Inflation in Australia is not simply moderating, it is shifting. With electricity prices set to rise sharply, compound demand from population growth, and ongoing federal deficit spending, the RBA will almost certainly need to tighten further. Knox’s analysis points toward four additional rate hikes and a cash rate that must rise to around 4.6 percent before inflation stabilises.

Want to discuss how this impacts your portfolio?

DISCLAIMER: Information is of a general nature only. Before making any financial decisions, you should consult with an experienced professional to obtain advice specific to your circumstances.