Research notes

Stay informed with the most recent market and company research insights.

Research Notes

Model update

1H25 result: Copper cushion, dividend disappoints

Moving in the right direction

Huge end to FY25 sets up for a stronger FY26

2Q25: Traffic and toll revenues

International Spotlight

International spotlight

International Spotlight

Price spike not enough to support valuation

Price spike not enough to support valuation

News & insights

Today, we’re diving into how the Reserve Bank of Australia (RBA) sets interest rates as it nears its target of 2.5% inflation, and what happens when that target is reached. Back in 1898, Swedish economist Knut Wicksell published *Money, Interest and Commodity Prices*, introducing the concept of the natural rate of interest. This is the real interest rate that maintains price stability. Unlike Wicksell’s time, modern central banks, including the RBA, focus on stabilising the rate of inflation rather than the price level itself.

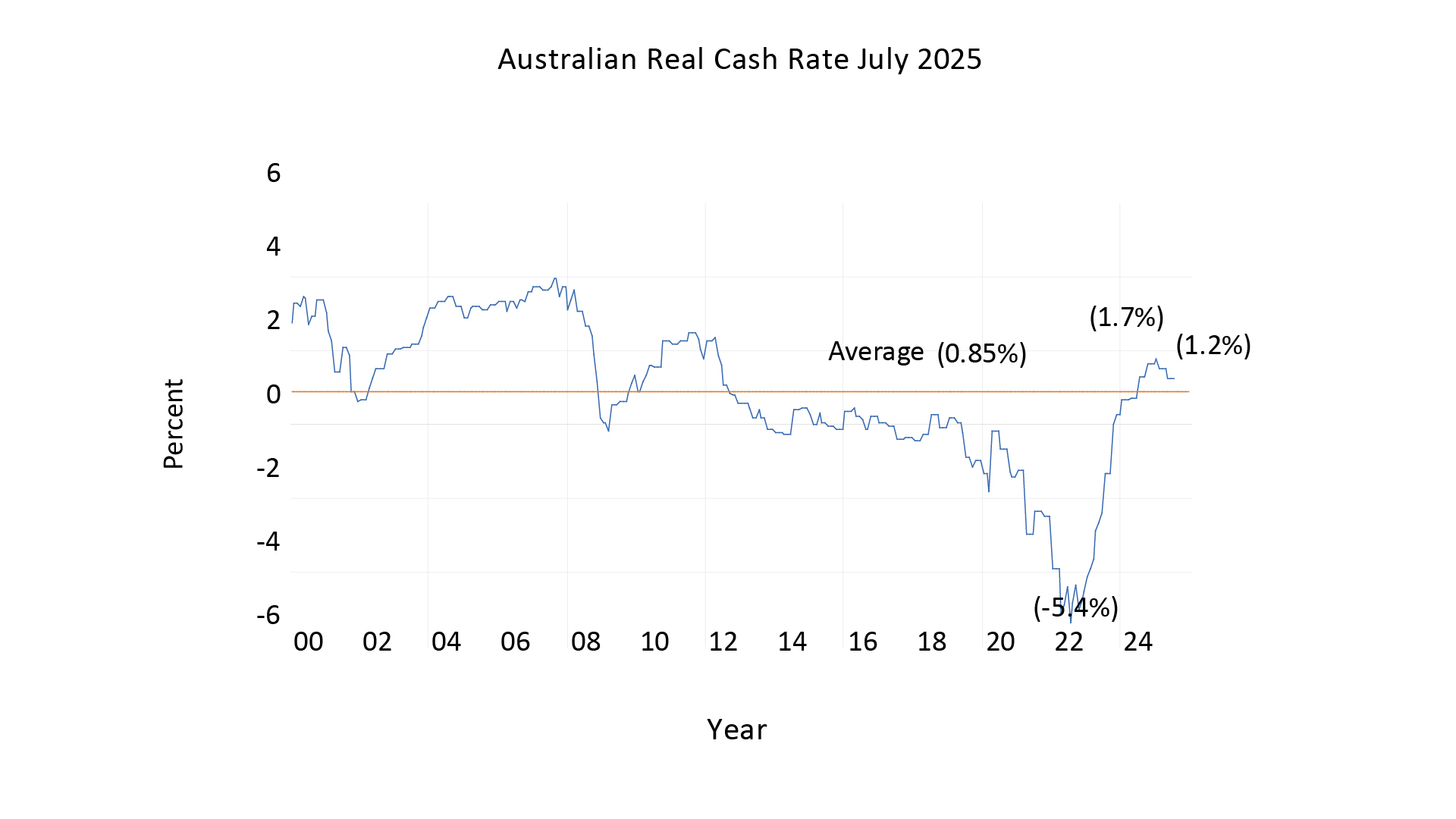

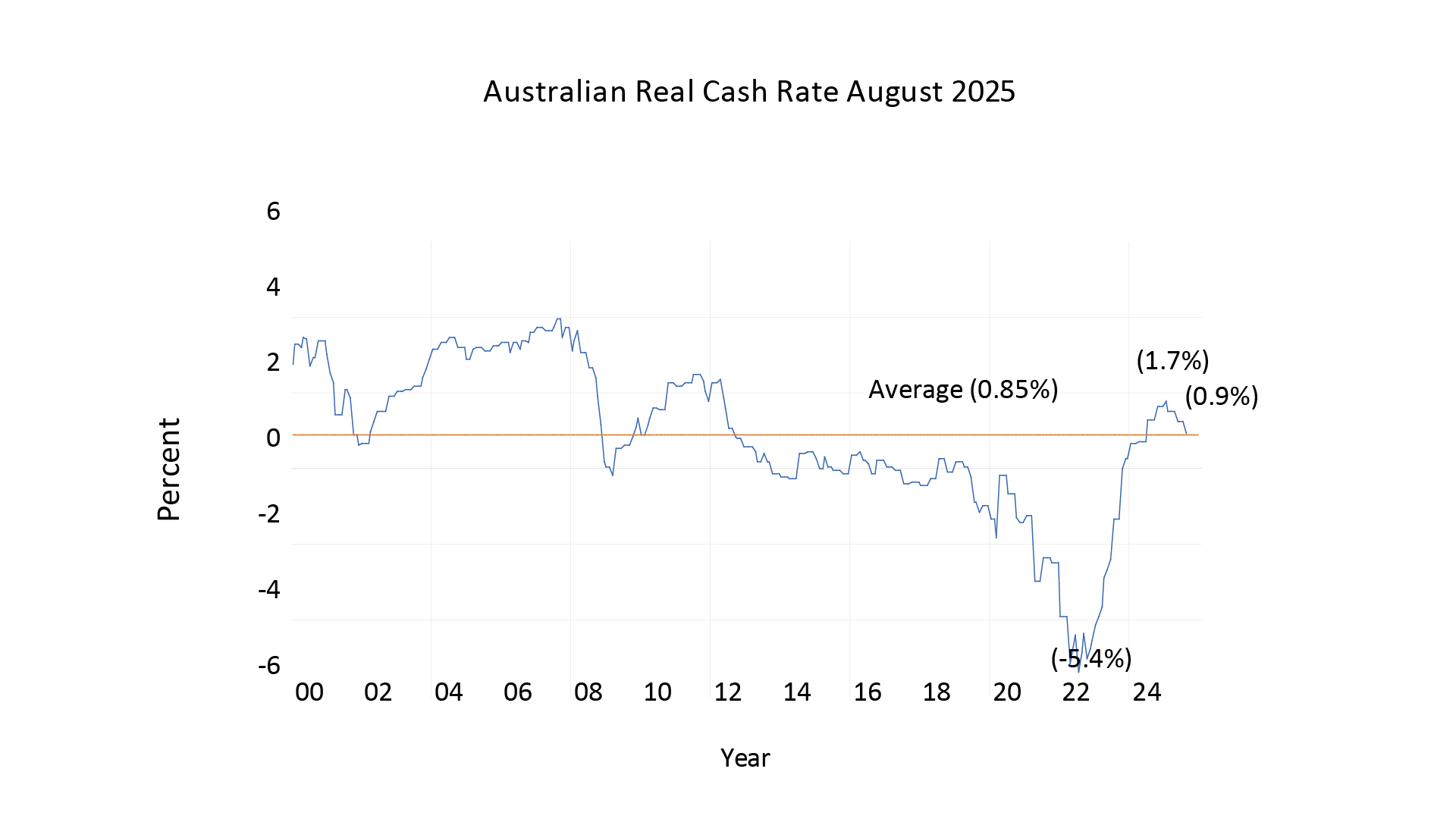

In Australia, the RBA aims to keep inflation at 2.5%. To achieve this, it sets a real interest rate, known as the neutral rate, which can only be determined in practice by observing what rate stabilises inflation at 2.5%. Looking at data from January 2000, we see significant fluctuations in Australia’s real cash rate, but over the long term, the average real rate has been 0.85%. This suggests that the RBA can maintain its 2.5% inflation target with an average real cash rate of 0.85%. This is a valuable insight as the RBA approaches this target.

As inflation nears 2.5%, we can estimate that the cash rate will settle at 2.5% (the inflation target) plus the long-term real rate of 0.85%, resulting in a cash rate of 3.35%. At the RBA meeting on Tuesday, 12 August, when the trimmed mean inflation rate for June had already dropped to 2.7%, the RBA reduced the real cash rate to 0.9%, resulting in a cash rate of 3.6%.

We anticipate that when the trimmed mean inflation for September falls to 2.5%, as expected, the cash rate will adjust to 2.5% plus the long-term real rate of 0.85%, bringing it to 3.35%. The September quarter trimmed mean will be published at the end of October, just before the RBA’s November meeting. We expect the RBA to hold the cash rate steady at its September meeting, but when it meets in November, with the trimmed mean likely at 2.5%, the cash rate is projected to fall to 3.35%.

In recent weeks, a number of media commentators have criticized Donald Trump's " One big Beautiful Bill " on the basis of a statement by the Congressional Budget Office that under existing legislation the bill adds $US 3.4 trillion to the US Budget deficit. They tend not to mention that this is because the existing law assumes that all the tax cuts made in 2017 by the first Trump Administration expire at the end of this year.

Let’s us look at what might have happened in January 2026 if the cuts in US corporate tax rates in Trumps first term were not renewed and extended in the One Big Beautiful Bill.

Back in 2016 before the first Trump administration came to office in his first term, the US corporate tax rate was then 35%. In 2017 the Tax Cut and Jobs Act reduced the corporate tax rate to 21%. Because this bill was passed as a "Reconciliation Bill “, This meant it required only a simple majority of Senate votes to pass. This tax rate of 21% was due to expire in January 2026.

The One Big Beautiful Bill has made the expiring tax cuts permanent; this bill was signed into law on 4 July 2025. Now of course the same legislation also made a large number of individual tax cuts in the original 2017 bill permanent.

What would have happened if the bill had not passed. Let us construct what economists call a "Counterfactual"

Let’s just restrict ourselves to the case of what have happened in 2026 if the US corporate tax had risen to the prior rate of 35%.

This is an increase in the corporate tax rate of 14%. This increase would generate a sudden fall in US corporate after-tax earnings in January 2026 of 14%. What effect would that have on the level of the S&P 500?

The Price /Earnings Ratio of the S&P500 in July 2025 was 26.1.

Still the ten-year average Price/ Earnings Ratio for the S&P500 is only 18.99. Let’s say 19 times.

Should earnings per share have suddenly fallen by 14%, then the S&P 500 might have fallen by 14% multiplied by the short-term Price/ Earnings ratio.

This means a likely fall in the S&P500 of 37%.

As the market recovered to long term Price Earnings ratio of 19 this fall might then have ben be reduced to 27%.

Put simply, had the One Big, beautiful Bill not been passed, then in 2026 the US stock market might suddenly have fallen by 37% before then recovering to a fall of 27% .

The devastating effect on the US and indeed World economy might plausibly have caused a major recession.

On 9 June Kevin Hassert the Director of the National Economic Council said in a CBS interview with Margaret Brennan that if the bill did not pass US GDP would fall by 4% and 6-7 million Americans would lose their jobs.

The Passage of the One Big Beautiful Bill on 4 July thus avoided One Big Ugly Disaster.

On 7 July the AFR published a list of 37 Economists who had answered a poll on when the RBA would next cut rates. 32 of them thought that the RBA would cut on 8 July. Only 5 of them did not believe the RBA would cut on 8 July. I was one of them. The RBA did not cut.

So today I will talk about how I came to that decision. First, lets look at our model of official interest rates. Back in January 2015 I went to a presentation in San Franciso by Stan Fishcer . Stan was a celebrated economist who at that time was Ben Bernanke's deputy at the Federal Reserve. Stan gave a talk about how the Fed thought about interest rates.

Stan presented a model of R*. This is the real short rate of the Fed Funds Rate at which monetary policy is at equilibrium. Unemployment was shown as a most important variable. So was inflationary expectations.

This then logically lead to a model where the nominal level of the Fed funds rate was driven by Inflation, Inflationary expectations and unemployment. Unemployment was important because of its effect on future inflation. The lower the level of unemployment the higher the level of future inflation and the higher the level of the Fed funds rate. I tried the model and it worked. It worked not just for the Fed funds rate. It also worked in Australia for Australian cash rate.

Recently though I have found that while the model has continued to work to work for the Fed funds rate It has been not quite as good in modelling that Australian Cash Rate. I found the answer to this in a model of Australian inflation published by the RBA. The model showed Australian Inflation was not just caused by low unemployment, It was also caused by high import price rises. Import price inflation was more important in Australia because imports were a higher level of Australian GDP than was the case in the US.

This was important in Australia than in the US because Australian import price inflation was close to zero for the 2 years up to the end of 2024. Import prices rose sharply in the first quarter of 2025. What would happen in the second quarter of 2025 and how would it effect inflation I could not tell. The only thing I could do is wait for the Q2 inflation numbers to come out for Australia.

I thought that for this reason and other reasons the RBA would also wait for the Q2 inflation numbers to come out. There were other reasons as well. The Quarterly CPI was a more reliable measure of the CPI and was a better measure of services inflation than the monthly CPI. The result was that RBA did not move and voiced a preference for quarterly measure of inflation over monthly version.

Lets look again at R* or the real level of the Cash rate for Australia .When we look at the average real Cash rate since January 2000 we find an average number of 0.85%. At an inflation target of 2.5 % this suggests this suggest an equilibrium Cash rate of 3.35%

What will happen next? We think that the after the RBA meeting of 11 and 12 August the RBA will cut the Cash rate to 3.6%

We think that after the RBA meeting of 8 and 9 December the RBA will cut the Cash rate to 3.35%

Unless Quarterly inflation falls below 2.5% , the Cash rate will remain at 3.35% .