- Market risks have escalated and serve as a reminder that ‘accidents’ do happen when central banks hike interest rates aggressively. Portfolios need a new investment playbook and be agile to change in this new market regime of stubborn inflation and elevated volatility.

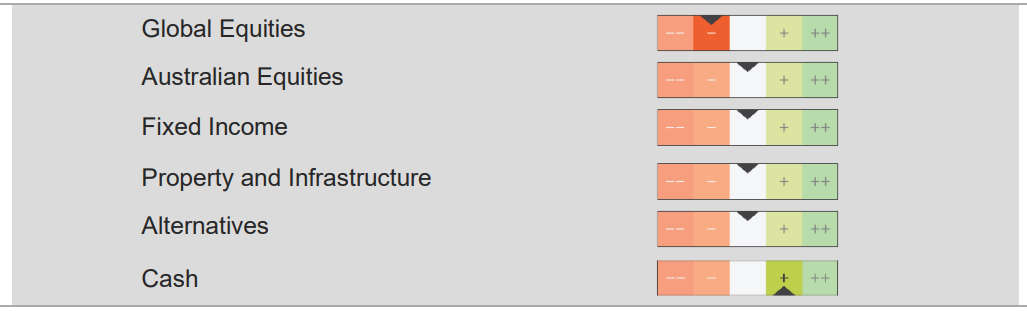

- This quarter we take a cautious tilt: overweight cash, underweight developed market (DM) stocks and neutral fixed interest/Australian equities. But we are ready to seize opportunities as macro damage gets priced in.

The consequences of rising interest rates

Cracks in the financial system appear as the lagged effects from a rapid succession of interest rates expose some vulnerabilities. However, unlike previous episodes of financial distress, this time, regulators appear to be on the front foot responding decisively with emergency liquidity to prevent broader contagion.

These measures give the troubled global banking system some breathing space, but it’s too early to say if there won’t be more casualties.

There are reasons for cautious optimism and a major banking crisis on par with the Global Financial Crisis (GFC) can be avoided. Unlike in 2007, there does not appear to be large credit losses hidden in opaque instruments on bank balance sheets. Post-GFC reforms mean that large global banks have more robust capital and liquidity buffers.

Risk presents opportunity, and we see a path for investors to succeed in the new regime. Investing in the energy transition, Australian/Emerging Market equities with a value/quality bias and investment grade credit offer the best risk/return profile for a market fretting about what is to come.

Inflation battle likely to take a lower priority for now

With central banks committed to restoring financial stability, the battle to contain inflation is likely to take a back seat in the short term. However, the focus could return just as quickly if regulators and central banks manage to restore confidence.

This has implications for long-duration assets which have seen some valuation relief since the onset of the banking troubles in March. Strategically speaking, we think the market could prove to be short-sighted in ignoring the persistence of inflation.

Nonetheless, in a slowing economic backdrop that sees growth fall and central banks turn less hawkish, a quality oriented fixed income portfolio could play an important role for returns and diversification. This will be especially true if stock/bond correlations turn negative again.

Seeking shelter in emerging economies

Markets have focused on the mayhem in the developed world. Under the radar has been confirmation that the economic restart in China from Covid restrictions is encouraging.

In addition, China’s monetary policy is supportive as the country has low inflation compared with DM. This should benefit Emerging Market (EM) assets. As a result, we keep our relative preference for EM over DM stocks (US/Europe).

Key changes to our asset allocation settings

This quarter we take a cautious tilt: overweight cash, underweight developed market (DM) equities and neutral Australian equities. This is because we don’t believe the market has fully discounted the risk to earnings from a global slowdown.

We take a more constructive view on Australian equities supported by higher commodity prices and strong employment conditions which should see the Australian equity market outperform global peers.

Figure 1: Morgans recommended asset allocation settings

Morgans clients receive access to detailed market analysis and insights, provided by our award-winning research team. Begin your journey with Morgans today to view the exclusive coverage.