About Us

Canberra

The Canberra office of Morgans was established in 1998 and offers clients a high level personalised service with a team based approach. Rather than having one adviser assigned to a client account, we assign a Financial Planner, an Investment Adviser and support staff.

We offer a range of different services to clients including financial planning, full service stockbroking, Self-Managed Super administration and management services, personal insurance, estate planning, options, budgeting and Sophisticated Investor offerings.

RBSM Canberra Pty Ltd is the service entity that manages the office of Morgans in Canberra and employs the advisers in that office.

Canberra

The Canberra office of Morgans was established in 1998 and offers clients a high level personalised service with a team based approach. Rather than having one adviser assigned to a client account, we assign a Financial Planner, an Investment Adviser and support staff.

We offer a range of different services to clients including financial planning, full service stockbroking, Self-Managed Super administration and management services, personal insurance, estate planning, options, budgeting and Sophisticated Investor offerings.

RBSM Canberra Pty Ltd is the service entity that manages the office of Morgans in Canberra and employs the advisers in that office.

Whether you're an experienced professional investor or a novice investor finding your way in the market, Morgans Canberra can help. As a full service stockbroker, we pride ourselves on offering smart, personalised investment advice that is tailored to your investment style and objectives. Our advisers are supported by an award-winning research team, as well as a leading corporate finance team that regularly provides clients with exclusive investment opportunities.

Services

We can provide you with:

Tailored share portfolios

- Advice on individual share selection and portfolio construction tailored to meet your specific investment objective.

Award-winning research

- Recommendations supported by comprehensive internal and external research, developed by our research analysts.

Access to local and international markets

- Access to all securities listed on the Australian Securities Exchange (ASX), the National Stock Exchange of Australia (NSX) and Chi-X Australia (Chi-X);

- Plus international equities access to 22 select exchanges, including the major markets in North America, Europe and Asia (ie Dow, NASDAQ, FTSE100, DAX, CAC, Hang Seng, Nikkei).

New investment opportunities

- Our clients gain access to the latest company IPOs and capital raisings.

Portfolio management

- We offer a Wealth+ managed portfolio service that takes the hassle out of investing by providing an all-embracing investment administration service.

Online account access

- Access to our client website, allowing you to monitor your investments, read award-winning research, and check share prices, announcements and more.

Contact us

We pride ourselves on providing client-focused advice based on thorough research, comprehensive company knowledge and many years experience in the Australian sharemarket. Contact us to find out more.

Tax planning is a key element of wealth creation. Salary packaging, superannuation, investments and tax deductible debt can create significant tax savings. By structuring your finances more efficiently you can manage the amount of tax you pay.

Tax planning can involve:

- Maximising your after tax income

- Remuneration packaging (salary packaging)

- Capital Gains Tax (CGT) management

- Gearing

- Investing in shares that offer 100% franked dividends

- Borrowing to invest

- Small business and capital gains tax exemptions (particularly relevant to superannuation)

- Generic tax planning advice

Because there are so many factors that contribute to the amount of tax you pay, it is important to obtain comprehensive advice.

General tax advice

For general tax advice, you should talk to your accountant. Morgans does not provide tax advice, however our investment advice and financial strategies may be structured in a way that can reduce tax and increase after tax returns on your portfolio.

Contact us

For help with structuring your investments and superannuation to maximise your after tax income, contact a Morgans Canberra adviser.

Morgans Canberra prides itself on providing a complete solution to all your financial needs. In addition to providing a range of share investment options, our advisers are able to include cash investment alternatives as part of your broader investment strategy.

As a Morgans client, you have access to advice and research across a wide range of listed and unlisted income and fixed interest securities.

Services available:

Income-focussed share portfolios

We specialise in building dedicated income-focussed portfolios for investors. Ask us how you can improve your income today.

Cash management accounts

We offer a range of at-call cash facilities paying attractive interest rates. Our preferred products provide you with direct bank deposits in your name with some of Australia's best known banks, all with "at-call" convenience, which means you can readily access your money.

These accounts can be linked directly to your share trading account for easy settlement. You can also have your dividend and interest payments credited directly to the account and make regular payments from it.

Your adviser can handle all the paperwork as well as ongoing transactional instructions, freeing you of the administrative burden.

Term deposits

A term deposit is a deposit held at a financial institution that has a fixed term, generally paying a higher interest rate than an "at-call" account. You can use a term deposit to enhance the returns on surplus cash balances and as the foundation for building a dedicated income portfolio.

Morgans has preferential relationships with a host of leading banks and other Authorised Deposit taking Institutions (ADIs). Funds can be swept from your "at-call" account and invested for the term and interest rate that best suits your needs.

Foreign currency term deposits

A foreign currency term deposit is a foreign denomination held at a financial institution that has a fixed term. Rates offered are very attractive on deposit amounts of AUD100,000 or greater.

Flexible/structured term deposits

Flexible term deposits offer the ability to combine both floating and fixed interest rate payments within a single deposit. This allows investors to structure interest payments based on their view of future interest rate levels. Morgans offers these products on deposit amounts of $100,000 or greater.

Listed debt and hybrid investments

As a major participant in the Australian listed fixed interest securities market, we can offer you advice as well as a range of new investment opportunities from a range of Australia's largest banks and industrial companies.

Listed debt and hybrid investments deliver higher levels of income, paid regularly; some also offer the benefits of franking. Your adviser can build a tailored income portfolio for you, which unlike managed fund alternatives, can be constructed to take into account your specific objectives and risk profile.

Government and corporate bonds

We offer a comprehensive Government bond investment service, including custody facilities. Bonds improve portfolio diversification and help reduce portfolio risk while providing stable income.

The yields on Government bonds will generally be lower than most other interest rate investments but provide absolute security when held to maturity.

Larger investors can also access the wholesale corporate bond market.

Contact us

For more information or a term deposit interest rate quote please contact a Morgans Canberra adviser.

Margin lending is borrowing money which you use, in addition to your own money, to invest in financial products such as shares and managed funds.

Essentially, you are "leveraging" the value of your investments through borrowing.

You must have adequate cash or existing shares to use as security for the loan. Only certain shares can be used as security and the amount that can be borrowed will vary for different shares.

Benefits

- Margin lending can give you an opportunity to increase the size of your investments and to diversify your investments. Diversifying your portfolio can reduce your level of risk in the market.

- It can also provide an opportunity to increase the gross return on your own equity by achieving excess returns over tax and borrowing costs.

- Borrowing also allows you to invest at a time you want to invest, rather than having to wait until you have saved enough. This can help you avoid missing out on investment opportunities.

- Interest on borrowed funds is generally tax deductible provided the funds are invested in Australian assets for income-producing purposes.

Please note: Deriving a tax benefit should not be your core focus. You should seek qualified tax advice from a registered tax agent so that you fully understand your personal tax position.

Borrowing limits

Margin lenders generally only allow you to borrow up to a certain value, or percentage, of the shares you wish to buy.

Commonly, limits are set at a maximum of 75% (known as the Loan-to- Value Ratio or LVR) of the value of the shares (less if the share is more speculative or risky). This means you have to make up the difference (ie 25%) with your own cash or existing shares.

This difference is referred to as the “margin”; hence the term “margin lending”.

Borrowing risks

Any borrowing strategy should always be approached with caution.

While borrowing to invest has the ability to leverage returns from investments, it also heightens investment risk. This is because you have a greater amount invested, which will magnify your losses if returns are negative.

Margin lending should be implemented as a long-term investment strategy to allow time to overcome any market volatility and for the leveraging effects to work.

Contact us

Borrowing to invest can be an effective long term strategy for wealth creation as long as you understand the risks and the impact gearing may have on your overall returns.

Contact your Morgans Canberra adviser to seek advice on whether utilising a margin lending strategy is appropriate for you.

You can access a wealth of experience and technical expertise through our financial planning team at Morgans Canberra. We can work with you to tailor wealth solutions that help you reach your investment goals.

Financial planning is taking advantage of all the investment opportunities available to you. With the right advice and a patient investment approach, becoming a successful investor can be relatively simple.

What we do

Our experienced financial advisers build personalised financial plans that aim to create, grow and protect your wealth.

We specialise in:

- Selecting appropriate assets to build your wealth

- Wealth protection through personal insurance

- Superannuation strategies

- Self-managed Superannuation Fund (SMSFs)

- Tax planning to manage the amount of tax you pay

- Planning for your retirement

Our approach

Your Morgans adviser will take you through the wealth management planning process, implement your strategies and help you make the most of all opportunities.

This wealth management process helps you set short- and long-term goals and use a range of investment strategies to achieve those goals.

Strategies are developed around the principles of saving tax, choosing the right investment structures, minimising risk, personal insurance and generating a large-enough asset base to provide you with financial security.

The strategies to save tax involve structuring salary, superannuation, investments and debt. Risk is minimised through the diversification of investments and monitoring portfolio performance.

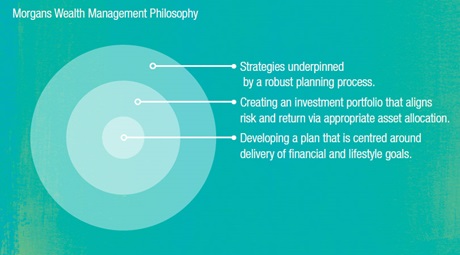

Wealth management philosophy

Your Morgans adviser will work with you to put in place a wealth management plan that will help you achieve your lifestyle goals – or help you create a better life.

Life stage planning

Through each stage of your life you will focus on issues that are relevant at that time. We can implement strategies that help you create and save your wealth, regardless of your life stage.

View our guides for the key things to consider during your twenties, thirties and forties and when transitioning to retirement:

- In your 20s – Guide to financial independence

- In your 30s and 40s – Guide to financial independence

- Life begins at ... – Guide to financial independence

Contact us

With the right advice and a patient investment approach, becoming a successful investor can be relatively simple. To find out more, contact a Morgans Canberra adviser today.

The team at Morgans Canberra stays informed on the vast number of personal insurance products in today’s market. We can provide you with advice to help you select the right cover to protect you in the event you need it.

Half of all Australians over the age of 30 will suffer a major illness that can lead to a long-term disability, and consequently, a long-term loss of income.

Could you afford to take several months off work without pay? If you are self-employed, could your business survive if you weren't around? If the answer is no, then it is important to look at protecting yourself against these risks.

Type of protection

Life insurance

The most common component of a risk insurance solution is life insurance. How it works is straight forward – in the event you die, your beneficiaries (spouse, children, business partners, whomever is nominated) will receive a lump sum payment.

This could be any amount up to millions of dollars to cover all loans and debts you may have, and to cover the future well being of your loved ones.

Total and Permanent Disability (TPD) insurance

TPD insurance covers you in the event you're totally and permanently disabled and unable to work due to illness or injury. In the event this occurs, you will receive a lump sum payment.

Income protection

Income protection provides income replacement options to protect your lifestyle, assets and independence if you suffer illness or injury. It will provide a monthly payment of up to 75% of your income while you are unable to work due to accident or sickness.

Trauma insurance

Trauma insurance protects you from serious medical conditions and illnesses. You will receive a lump sum payment if you are diagnosed with or suffer a life-threatening illness, allowing you to concentrate on what you really need at this time – your recovery.

Business expense insurance

Business expense insurance covers any ongoing expenses of your business, such as rent, salaries, electricity and loan repayments, or bringing in a locum to run the business while the primary income generator is unable to work due to sickness or injury.

If you are the primary income generator in a small business, or if you are self employed, you should consider this sort of cover.

How can we help?

Given the vast number of personal insurance products on the market, it can be difficult deciding on the right cover for your situation.

It is our job to understand every detail of all available products so that we can recommend policies and strategies that suit your individual needs and budget. We can also advise you on ways that your policy can be structured to save you money.

Contact us

Contact a Morgans Canberra adviser to find out more information or to discuss your wealth protection options.

Options

An option is a contract between two parties giving the taker (buyer) the right, but not the obligation, to buy or to sell a parcel of shares at a specified price on (or before) a specified date.

There are two types of options traded on the ASX: call options and put options.

- Call options give the taker the right, but not the obligation, to buy the underlying shares

- Put options give the taker the right, but not the obligation, to sell the underlying shares

You can trade options over most of Australia's largest companies, including News Corporation, Telstra, BHP Billiton and the major banks.

Advantages of options trading

Risk management

A simple strategy is to use put options which allow investors holding shares to hedge against a possible fall in their value. This can be considered similar to taking out insurance against a fall in the share price.

Time to decide

By buying a call option, the purchase price for the shares is locked in. This gives the call option holder until the expiry date to decide whether or not to exercise the option and buy the shares. Likewise, the buyer of a put option has time to decide whether or not to sell the shares.

Ease of trading

The ease of trading in and out of an option position makes it possible to trade options even if there is no intention of ever exercising them. If an investor expects the market to rise, they may decide to buy call options and vice versa. Either way the holder can sell the option prior to expiry to take a profit or limit a loss.

Leverage

Leverage provides the potential to make a higher return from a smaller initial outlay than investing directly. However, leverage usually involves more risk than a direct investment in the underlying shares. Trading in options can allow investors to benefit from a change in the price of the share without having to pay the full price of the share.

Diversification

ASX's options market allows investors to build a diversified portfolio for the same or even lower initial outlay than purchasing shares directly.

Income generation

Share holders can earn extra income over and above dividends by writing call options against their shares. By writing an option they receive the option premium upfront. While they get to keep the option premium, there is the possibility that they have to sell their shares to the buyer of the option at the exercise price. This is called a 'covered write' strategy.

Disadvantages of options trading

- Options are not without a higher level of risk and therefore may not be appropriate for everyone.

- Time value erosion may adversely affect the price of bought option positions even if the underlying instrument moves in the desired direction.

- As options can be used as a leveraging tool, losses may be magnified and created quickly.

- Options have a finite life and need to be monitored closely, with a great deal of observation and maintenance.

Warrants

Warrants are a form of derivative issued by a bank, government or other financial institution and traded on the ASX and Chi-X.

They allow investors to trade an underlying instrument, such as shares, without having to own the shares outright.

There are different types of warrants available for trading or investment including Self Funding Instalments, trading warrants, MINIs, barrier warrants, commodity warrants, currency warrants, structured investment products and endowment warrants. Some warrants have higher risk/return profiles than others.

Warrants can be either call warrants or put warrants:

- Call warrants benefit from an upward price movement in the underlying instrument

- Put warrants benefit from a downward trend

Advantages

Some warrants, such as instalments, allow investors to gain the major primary benefits of share ownership including:

- Participation in capital movements in the shares

- Receipt of dividends and franking credits

Instalment warrants, put simply, are a loan to buy shares without the obligation to repay the loan. You only have to make an initial payment and the final payment is optional and payable at a later date.

Self Managed Superannuation Fund (SMSF) members can use instalments to legally gear their fund.

Disadvantages

- Some warrants have features that make them riskier than others.

- Time value erosion may adversely affect the price of a warrant even if the underlying instrument moves in the desired direction.

Contact us to seek specific advice about the risks and features of particular warrants.

Education material

Online

The ASX Education section also provides access to interactive and educational material covering various topics, including Options and Warrants.

Print (PDFs)

More information on options adjustments in regard to Rights Issue / Corporate Action events can be seen on the ASX website.

Contact us

Contact your Morgans Canberra adviser to discuss whether an options strategy is appropriate for your own personal circumstances and needs.

New investment opportunities are regularly made available to our clients across all asset classes and industry sectors through company IPOs and capital raisings. View our latest offers here.

Superannuation is arguably the most tax-effective method of saving for your retirement. For many of us, it is the largest asset we have, apart from our homes.

With a variety of contribution options, superannuation can be a complex area for the uninformed.

It's important to form a strategy to make the most of the tax concessions, financial incentives and rebates. This will help to ensure your superannuation savings provide a comfortable standard of living in retirement.

Strategy

By forming a strategy, you may take advantage of:

- Transition to Retirement (TTR) rules

- Choice of superannuation

- Self Managed Superannuation Funds(SMSF)

- Salary packaging (also known as salary sacrifice)

- Retirement income streams

How to make contributions

- Employer Super Guarantee Contributions

- Employee – Salary sacrifice contributions

- Salary forfeited as contributions to super instead of taking as taxable income.

- Employee – Voluntary contributions (after tax)

- Could be eligible for Government co-contribution payments if other conditions are met.

- Self employed – deductible contributions or non-deductible contributions

- Not working and under 65 – (non-deductible)

- Ability to make deductible contributions will depend on taxable income.

- Spouse – spouse splitting of spouse contributions, or contributions on behalf of a spouse.

You can view the new superannuation thresholds for 2023/24 here.

How to enjoy your income in retirement

Your decision about where and how your money is invested in superannuation could increase your income in a number of ways.

By rolling your superannuation money into a pension income stream at or after retirement, you can:

- generate more tax-effective income

- receive more generous Centrelink treatment

- have the flexibility to decide how your assets will be left to your beneficiaries.

- Account-based pensions are the most common form of superannuation pension. They are specifically derived from superannuation money.

The pension income is paid from the balance of the money remaining in the your superannuation fund each year until it runs out. Payments can commence following full retirement after preservation age, or if you are permanently unable to work due to invalidity, or at age 65 regardless of whether retired or not at that time.

An account-based pension can offer a range of flexible investment options. You can position your investments so they are more effective in meeting income and growth needs in retirement.

This flexibility means control is ultimately retained by you over the level of investment risk and return within the fund.

How can we help?

Download our comprehensive Superannuation Advice Brochure for more information on how to maximise your superannuation savings and create a comfortable standard of living in retirement.

Alternatively contact one of our experienced advisers to discuss your superannuation strategy. With a dedicated technical research team, and regular development opportunities, our advisers are kept up to date with legislation changes, the latest strategies, and ways to make the most of your superannuation.

Contact us

Be it consolidating your superannuation accounts, understanding how much you can contribute each financial year, discussing the merits of Self Managed Superannuation Funds (SMSF), or developing strategies to prepare you for your eventual retirement, our Morgans Canberra advisers can assist you.

Wealth+ SMSF Solution is our self managed super fund (SMSF) administration service that incorporates the establishment, management, administration and investment advice for your fund.

Simply put, this offering allows you to take advantage of the flexibility and control of an SMSF while outsourcing the work involved in establishing and running your fund.

Complete SMSF service

As a Wealth+ SMSF Solution client, you have just one point of contact, a Morgans adviser, who will manage the key SMSF services you require, including:

Trust Deed establishment

You will receive a Reckon Docs Pty Ltd SMSF Trust Deed, which is a high quality SMSF Trust Deed, drafted by SMSF specialists with the client in mind.

Fund administration

This includes:

- Preparation and maintenance of all statutory member records and reporting

- Preparation of annual financial reports

- Advice on compliance with the fund’s trust deed and the SIS Act and Regulations

- Arranging annual audit in accordance with instructions from trustees

- Liaison with external auditors in all matters relating to the fund preparation and lodgement of income tax return

- Preparation and lodgement of income tax return

- Preparation of minutes of trustee meetings

- Maintenance of accounting records

- Contribution reporting

- Monitoring compliance of investments held against the fund’s investment strategy

- Obtaining actuarial certificate, as required by legislation

- Preparation of withdrawal and pension documentation

Investment management

Your SMSF investments are managed through our Wealth+ Managed Portfolio Service, which provides you with comprehensive reporting on your fund portfolio and investments, in addition to your annual member statement.

Benefits of Wealth+:

- you maintain control over investment decisions, but outsource professional management and administration of your portfolio, leaving time for you and your adviser to take a pro-active approach to investing - including recommending changes if considered appropriate

- if required, we provide regular income payments to designated accounts or to meet your regular payment needs. You have a choice of some of the leading cash management providers and receive comprehensive portfolio reporting

Investment advice

You'll have access to the expertise of one of Australia's largest stockbroking and wealth management networks.

Your adviser is supported by Morgans research on companies and is kept updated on any superannuation and legislation changes. This provides you with sound advice for your SMSF investment strategy.

Saves you time

With your Morgans adviser being your one point of contact for your SMSF, you can eliminate several visits to different professionals that you would require if administering the SMSF on your own – such as an accountant or lawyer for your trust deed, an accountant for your administration, an auditor for your annual fund audit and a financial adviser for your investment strategy and advice.

Tax and pensions

Wealth+ SMSF Solution allows trustees to better manage the tax outcomes of their fund and individual member accounts. Tax can be lowered through the use of franking credits. Capital gains and losses can also be specifically monitored for the benefit of members.

When an SMSF starts to pay a pension, the trustees may be entitled to claim a tax exemption on the earnings of the assets used to fund the pension.

This tax exemption provides a significant benefit for retirees, particularly when the fund holds shares paying franked dividends.

Streamlined fees

With some SMSF providers, the external audit, investment management and advice fees are separate costs. Wealth+SMSF Solution provides a simpler fee structure, automatically deducting all fees from your Wealth+ cash account.

More information

For more detail download our latest brochure.

More and more people are realising the advantages of making their own investment decisions and taking control of their retirement strategy.

An increasingly popular way of doing this is by setting up a self managed superannuation fund (SMSF).

An SMSF gives members of the fund control over specific investment choices involving their superannuation. They can tailor their own investment strategies and select specific assets such as listed securities, managed investments, cash and term deposits, international equities, instalment warrants and so on.

How can we help?

Morgans offers a variety of services for SMSFs, including structure, setup, advice, rollovers, investments, administration and compliance.

We have investment advisers who specialise in superannuation and a technical research team that provides updates and support on the latest in superannuation developments.

Our Services

SMSF administration & investment reporting

Our Wealth+ SMSF Solution is an all-encompassing investment administration and SMSF administration service that allows you to take advantage of the flexibility and control of an SMSF, but outsource the work involved in establishing and running your fund.

Your SMSF investments are managed through our Wealth+ Managed Portfolio Service, which provides you with comprehensive reporting on your fund portfolio and investments, in addition to your annual member statement.

Investment reporting

Clients and their accountants can benefit from our Wealth+ Managed Portfolio Service, which is a reporting facility that we offer for investment administration. This service makes investing easier by collecting and recording all investment information/documentation, however SMSF trustees will need to arrange annual administration of the SMSF using an accountant or administrator.

SMSF administration

Our SMSF administration only service provides fund administration without the portfolio administration. Please contact us or your Morgans Canberra adviser to find out more.

More information

If you would like to find out more before contacting one of our advisers, the Morgans technical research team has produced An essential guide to taking control of your super, which provides further detail on SMSFs.

Retirement planning is the accumulation of wealth to provide income and financial security in retirement. Estate planning focuses on wealth preservation and wealth transfer.

How can we help?

With a dedicated technical research team Morgans' advisers are kept up to date with legislation changes.

If you are planning your retirement, just reducing your working hours, or thinking about an estate plan, we can help.

Retirement planning

Good retirement planning is both tax efficient and investment effective. It's never too early to start planning for retirement. It is important to ensure your retirement income is structured to suit your needs and objectives.

Income in retirement

The three main sources of income in retirement are:

- Superannuation – pension income stream and/or lump sum withdrawals

- Non-superannuation assets – returns from shares, property, cash and fixed interest

- Centrelink – age pension benefits

We can help you to structure your retirement income stream to best meet your financial needs.

Estate planning

Estate planning aims to preserve your family’s wealth by distributing it to nominated beneficiaries in the most effective way.

It requires a consideration of each beneficiary’s personal and financial circumstances to determine the best means of providing an inheritance without unfairly affecting the beneficiary’s existing situation.

The first step is ensuring you have a current and valid will. In addition to a will, you should also think about:

- Powers of Attorney

- Medical directives

- Testamentary trusts

- Business succession planning

- Nomination of superannuation death benefits

Superannuation does not come under the direction of your will. Without sufficient planning, the trustee of your superannuation fund has discretion as to the treatment of any death benefits from your super.

A binding death nomination can ensure your wishes are fulfilled in the payment of benefits to your preferred beneficiaries.

Implications for SMSFs

With respect to self managed superannuation funds, trustees and members effectively have ultimate control in the distribution of death benefits within your fund.

It is important you prepare a strategy for the payment of benefits to members' chosen beneficiaries and incorporate the facilities to implement this strategy in your trust deed. It will also be necessary to make preparations for the wind-up of the fund in the event of the deaths of all trustees and members.

Find out more

If you are planning your retirement, just reducing your working hours, or thinking about an estate plan, we can help. Contact a Morgans Canberra adviser to discuss your needs.

Wealth+ is a portfolio management service that makes investing easier by collecting and recording all investment information/documentation (share trades, dividend and interest payments etc) as well as providing clients with regular reports to help them monitor portfolio valuations and forecast income.

Many investors are time poor or have no wish to administer their portfolio and this is where Wealth+ can help. This service gives clients more time to focus on their investment decisions rather than the cumbersome paperwork.

How Wealth+ works

All investments are held in your name (unlike other platforms where the investments are pooled with other investors in a single custodian name) and the address for your investments is changed to care of the Wealth+ managed portfolio service.

Wealth+ receives and deals with all of your correspondence and paperwork. We will follow up on any missing documentation or entitlements such as dividend payments and deal directly with share registries and other product providers.

You will be contacted by your adviser regarding new investment opportunities (e.g. entitlement offers, share purchase plans etc). You simply signal your acceptance and we look after all the relevant paperwork and lodge the application with the relevant registry on your behalf.

The benefits

- Proactive management of your portfolio - your investment portfolio is closely monitored and where appropriate recommendations are made

- One point of contact for all your investment needs - you have the comfort of knowing that the adviser you currently have a relationship with will play a role in the administration of your portfolio

- Reduced paperwork - we receive and manage documentation relating to your investments (such as share trades, dividend and interest payment advices etc.)

- Transparent reporting - our service provides you with regular reports to help monitor your portfolio valuation and forecast income

- Hassle free tax returns - we prepare a comprehensive tax report for the preparation of your tax. We can also liaise with your Tax Accountant to provide them with all the information they need

- Assistance with tax - we determine the correct tax treatment for the cost base of investments involved in complex schemes of arrangement, takeovers etc.

- 24 hour access to your portfolio - you have 24 hour online secure web access to your portfolio details with 20 minute delayed price updates for listed investments. View an example webpage.

- Access to capital raisings - you receive timely information regarding capital raisings (e.g. IPOs, entitlement offers etc) so you don’t miss out on any investment opportunities

- Ease of cash transacting - third party payments can be arranged for you at no cost

- Your Wealth+ fees may be tax deductible - for most investors, the ongoing portfolio management fees are tax deductible

More information

Please refer to our latest brochure on Wealth+ for more detailed information.

Contact us

Contact a Morgans Canberra adviser to find out more.

Making your money work for you!

Most people struggle to achieve their financial goals from a perceived lack of income. In fact, we find that most people earn more than enough to fund their goals but they don't have a plan for achieving it nor do they understand what is required to make it happen.

Your Future Wealth is a one-on-one coaching program, designed to take you step by step through the process of developing the systems and habits required to build long term wealth.

Our experienced team will assist you to develop the skills and tools necessary to gain better financial control. Better control means that you will be able to develop plans to achieve your financial goals like, purchase a house, reduce personal debt, travel the world or create investments for the future.

As part of the Your Future Wealth process, we will coach you through the process of creating and maintaining a realistic financial management system and keep you accountable for sticking to it.

In addition to helping you take control of your cash flow we will help you get you complete financial house in order, this means:

- the consolidation of your superannuation to give you greater control of your investments and to optimise your returns over the longer term

- review of your insurance needs to ensure that you protect your biggest asset (your ability to earn money)

- ensuring that your wills and estate planning is up to date

- giving you a plan to eliminate lifestyle debt

At Your Future Wealth, we aim to educate you on making your money work best for you - no matter your situation.

Contact us

Contact us today to find out how Morgans Canberra can help.

Advisers

Support Staff

Contact us today.

Office Address

Level 1 25 Napier Close Deakin ACT 2600 Australia

Postal Address

PO Box 63 Curtin ACT 2605 Australia

Phone

02 6232 4999

Open Hours

8:30am - 5:00pm

Our Approach

We offer a comprehensive financial solution tailored to your needs, beginning with a free discovery meeting to understand your financial situation and goals.

Following a structured process, we develop a personalised financial strategy, present it clearly in a Statement of Advice, assist with implementation, and provide ongoing review and support to ensure your financial goals are met.

Our Investment Process

At Morgans Port Macquarie, advisers collaborate with clients to establish investment goals centred on principles such as long-term investing, maintaining a quality core portfolio, diversification to reduce risk, focusing on total return, employing an active yet risk-controlled approach, conducting research-driven processes, and managing portfolios for tax efficiency.

.webp)

Community Support

The Morgans Foundation has been dedicated to supporting Australian charities since its establishment in 2005, and we are immensely proud of the impact we've been able to make. The Foundation pools funds from Morgans, its regional offices, clients and staff, to make meaningful contributions to selected charities.

Morgans Port Macquarie is proud to support various local charities and organisations such as:

• Port Macquarie Golf Club

• Kew Golf Club

• Port Macquarie Pirates

• Hastings Business Women’s Network

• Hastings Education Fund

• Business Port Macquarie

• Hastings Valley Motorcycle Club

• Liberty Domestic & Family Violence Specialist Services

• and more…

.webp)

Careers

At Morgans, we offer an array of exciting career opportunities in the dynamic industry of finance.

Whether you're at an early stage in your career or a seasoned professional, you’ll have the opportunity to make a genuine difference and be part of a culture where everyone’s contribution is recognised.

.webp)

Community Support

The Morgans Foundation has been dedicated to supporting Australian charities since its establishment in 2005, and we are immensely proud of the impact we've been able to make. The Foundation pools funds from Morgans, its regional offices, clients and staff, to make meaningful contributions to selected charities.

We recognise the importance of supporting the community in which we work and in assisting those in need of support.

.webp)

Community Support

At Morgans Bundaberg, we are committed to giving back to our community. Throughout the year, we support various local charities and organisations, making a meaningful difference in the lives of those around us. From sponsoring local events to contributing to charitable causes, we actively engage with and support initiatives that align with our values and goals.

.webp)

Community Support

The Morgans Foundation has been dedicated to supporting Australian charities since its establishment in 2005, and we are immensely proud of the impact we've been able to make. The Foundation pools funds from Morgans, its regional offices, clients and staff, to make meaningful contributions to selected charities.

We love to support our community and local charities. Some of these include Rotary and Newcastle Special Children's Christmas party. If you have a campaign you'd like us to get involved in, please contact to discuss further.

.webp)

Community Support

The Morgans Foundation has been dedicated to supporting Australian charities since its establishment in 2005, and we are immensely proud of the impact we've been able to make. The Foundation pools funds from Morgans, its regional offices, clients and staff, to make meaningful contributions to selected charities.

Morgans Coffs Harbour also supports:

• Community Radio 2CHY

• Coffs Harbour & District 60's & Over Social Bowling Club

• Rotary Club of Coffs Harbour

• Coffs Harbour Surf Life Saving Club

• Bonville Golf Resort

.webp)

Community Support

The Morgans Foundation has been dedicated to supporting Australian charities since its establishment in 2005, and we are immensely proud of the impact we've been able to make. The Foundation pools funds from Morgans, its regional offices, clients and staff, to make meaningful contributions to selected charities.

Morgans Cronulla also supports:

• The Salvation Army - Red Shield Appeal

• Cure Cancer Australia Foundation

.webp)

Community Support

The Morgans Foundation has been dedicated to supporting Australian charities since its establishment in 2005, and we are immensely proud of the impact we've been able to make. The Foundation pools funds from Morgans, its regional offices, clients and staff, to make meaningful contributions to selected charities.

Morgans Springfield-Ipswich also supports:

• Ipswich Region Chamber of Commerce

• Member of the Greater Springfield Chamber of Commerce

• Motor Neuron Disease Fundraising Sponsorship

• Alzheimer's Australia

• Multiple Sclerosis Fundraising Sponsorship

.webp)

Community Support

The Morgans Foundation has been dedicated to supporting Australian charities since its establishment in 2005, and we are immensely proud of the impact we've been able to make. The Foundation pools funds from Morgans, its regional offices, clients and staff, to make meaningful contributions to selected charities.

Morgans Sunshine Coast make regular donations to:

• Sunshine Coast Police Citizens Youth Club

• Rotary Clubs (Specific Needs Children)

• RSPCA

• Cancer Research Institute of Australia

.webp)

Community Support

The Morgans Foundation has been dedicated to supporting Australian charities since its establishment in 2005, and we are immensely proud of the impact we've been able to make. The Foundation pools funds from Morgans, its regional offices, clients and staff, to make meaningful contributions to selected charities.

Morgans Wollongong also supports:

• Make A Wish Australia

• Vision Australia

• Camp Quality Camp

Award winner

We are delighted to have been named winner of the Excellence in Operations Award at the 2021/2022 Morgans Branch Awards.

Community support

In 2021, Exchange Place Investments established the Exchange Places Fund through Foundation SA to consolidate and focus its philanthropic activities.

With a clear vision, Morgans Exchange Place quickly aligned its values and objectives with those of the Tjindu Foundation — both organizations seeking to create positive, long-term change for Aboriginal children in communities across South Australia.

After an initial contribution to the Tjindu Foundation, Exchange Place made a three-year commitment to partner with Tjindu, committing $50,000 annually and maximizing the impact of its giving.

.webp)

Community Support

The Morgans Foundation has been dedicated to supporting Australian charities since its establishment in 2005, and we are immensely proud of the impact we've been able to make. The Foundation pools funds from Morgans, its regional offices, clients and staff, to make meaningful contributions to selected charities.

Morgans Perth also supports:

• The Salvation Army

• Youth Focus

• Australia's Biggest Morning Tea

• Princess Margaret Hospital Foundation

• Redkite

.webp)

Community Support

The Morgans Foundation has been dedicated to supporting Australian charities since its establishment in 2005, and we are immensely proud of the impact we've been able to make. The Foundation pools funds from Morgans, its regional offices, clients and staff, to make meaningful contributions to selected charities.

Morgans Scone also supports:

• The McGrath Foundation

Morgans Scone is proud to support the local community, some of the organisations we support include:

• Scone Junior Rugby League

• Scone Junior Rugby Union

• Scone Swimming Club

• Scone Grammar School

• Scone Rugby Union Club

• Upper Hunter Beef Bonanza

.webp)

Community Support

The Morgans Foundation has been dedicated to supporting Australian charities since its establishment in 2005, and we are immensely proud of the impact we've been able to make. The Foundation pools funds from Morgans, its regional offices, clients and staff, to make meaningful contributions to selected charities.

We recognise the importance of supporting the community in which we work and in assisting those in need of support. Morgans Orange also supports:

• The Salvation Army - Red Shield Appeal

• Australia's Biggest Morning Tea

.webp)

Community Support

The Morgans Foundation has been dedicated to supporting Australian charities since its establishment in 2005, and we are immensely proud of the impact we've been able to make. The Foundation pools funds from Morgans, its regional offices, clients and staff, to make meaningful contributions to selected charities.

We recognise the importance of supporting the community in which we work and in assisting those in need of support. Morgans Merimbula also supports:

• Reaching Out Foundation

• Tulgeen Disability Services

Morgans Merimbula supports a variety of community fundraising events throughout the region:

• Local sporting events

• Business awards

• Surf Life Saving

• Horse racing

• Various charities

.webp)

Community Support

The Morgans Foundation has been dedicated to supporting Australian charities since its establishment in 2005, and we are immensely proud of the impact we've been able to make. The Foundation pools funds from Morgans, its regional offices, clients and staff, to make meaningful contributions to selected charities.

Morgans Milton have been ongoing corporate sponsors and we donate annually to many charities, The Leukaemia Foundation is one we hold close to our hearts with two of our staff having battled through cancer. We are currently raising funds for the "Light the Night" event at Southbank.

.webp)

Community Support

The Morgans Foundation has been dedicated to supporting Australian charities since its establishment in 2005, and we are immensely proud of the impact we've been able to make. The Foundation pools funds from Morgans, its regional offices, clients and staff, to make meaningful contributions to selected charities.

Morgans Domain also supports:

• Mazenod Old Collegians Football Club

.webp)

Community Support

The Morgans Foundation has been dedicated to supporting Australian charities since its establishment in 2005, and we are immensely proud of the impact we've been able to make. The Foundation pools funds from Morgans, its regional offices, clients and staff, to make meaningful contributions to selected charities.

We recognize the importance of supporting the community in which we work and in assisting those in need of support.

Morgans Hawthorn is also a supporter of Big Dry Friday supporting rural Australia.

.webp)

Community Support

The Morgans Foundation has been dedicated to supporting Australian charities since its establishment in 2005, and we are immensely proud of the impact we've been able to make. The Foundation pools funds from Morgans, its regional offices, clients and staff, to make meaningful contributions to selected charities.

Over the past 10 years Morgans Darwin has supported many local charities and community groups, as well as providing financial assistance to junior sportspeople.

Value in the Vines Investor Conference

The Value in the Vines Investor Conference is tailored for Morgans Scone clients, aimed at connecting investors with the CEOs of their invested companies.

Taking place annually in the picturesque Hunter Valley, NSW, the conference features high-quality company presentations, followed by an evening dinner featuring exclusive fireside chat panel discussion. This unique conference fosters a relaxed and intimate atmosphere, bringing together senior company executives and investors. An event you won’t want to miss!

The 2025 Conference is scheduled for Friday, 24 October 2025.

Building long-term partnerships

Morgans Chalk Capital advisers are dedicated to building long-term partnerships with clients, collaborating to identify and achieve financial goals. Their service is rooted in the Client Best Interest principle, a key element of the Financial Adviser Standards Code of Ethics.

Originally focused on stockbroking and investment transactions, the firm has evolved into a leading Financial Advice and Wealth Management provider.

With 30 years in the region, the Toowoomba office prides itself on delivering tailored, transparent services that foster trust and help clients manage investments, retirement savings, and financial strategies, creating lasting legacies for future generations.

Scholarship Program

Joining our scholarship employment program offers a unique opportunity to receive financial support, gain practical experience, and develop both personally and professionally in the dynamic field of financial planning.

You'll benefit from mentorship by seasoned professionals, receive financial assistance to ease the burden of tuition, and apply your classroom knowledge to real-world cases. This experience not only enhances your technical and soft skills but also prepares you for a successful career in financial planning, where you can contribute to the financial well-being of individuals and communities.

.webp)

Community Support

The Morgans Foundation has been dedicated to supporting Australian charities since its establishment in 2005, and we are immensely proud of the impact we've been able to make. The Foundation pools funds from Morgans, its regional offices, clients and staff, to make meaningful contributions to selected charities.

We recognise the importance of supporting the community in which we work and in assisting those in need of support.

.webp)

Community Support

The Morgans Foundation has been dedicated to supporting Australian charities since its establishment in 2005, and we are immensely proud of the impact we've been able to make. The Foundation pools funds from Morgans, its regional offices, clients and staff, to make meaningful contributions to selected charities.

We recognise the importance of supporting the community in which we work and in assisting those in need of support.

.webp)

Community Support

The Morgans Foundation has been dedicated to supporting Australian charities since its establishment in 2005, and we are immensely proud of the impact we've been able to make. The Foundation pools funds from Morgans, its regional offices, clients and staff, to make meaningful contributions to selected charities.

We recognise the importance of supporting the community in which we work and in assisting those in need of support.

.webp)

Community Support

The Morgans Foundation has been dedicated to supporting Australian charities since its establishment in 2005, and we are immensely proud of the impact we've been able to make. The Foundation pools funds from Morgans, its regional offices, clients and staff, to make meaningful contributions to selected charities.

We recognise the importance of supporting the community in which we work and in assisting those in need of support.

.webp)

Community Support

We recognise the importance of supporting the community in which we work and in assisting those in need of support.

.webp)

Community Support

The Morgans Foundation has been dedicated to supporting Australian charities since its establishment in 2005, and we are immensely proud of the impact we've been able to make. The Foundation pools funds from Morgans, its regional offices, clients and staff, to make meaningful contributions to selected charities.

Morgans Armidale also supports:

• Armidale Cycling Club

• Armidale Riding Club

.webp)

Community Support

Morgans Brighton is dedicated to fostering community support and engagement. Our office proudly backs a range of not-for-profit organizations and charities, including:

• Bayley House

• St Kilda Mums

• Oz Child

• Bayside Argonauts Soccer Club

• Murrumbeena Football Netball Club

• Courage to Care

By supporting these initiatives, we aim to make a positive impact and contribute to the well-being of our community.

Our Value Proposition

Learn how our wealth management strategies can assist in consolidating your family’s assets, managing your investments with your financial goals, tailoring your superannuation strategy and ensuring families and business owners have planned for their succession.